- October 7, 2023

- By hasibdm230

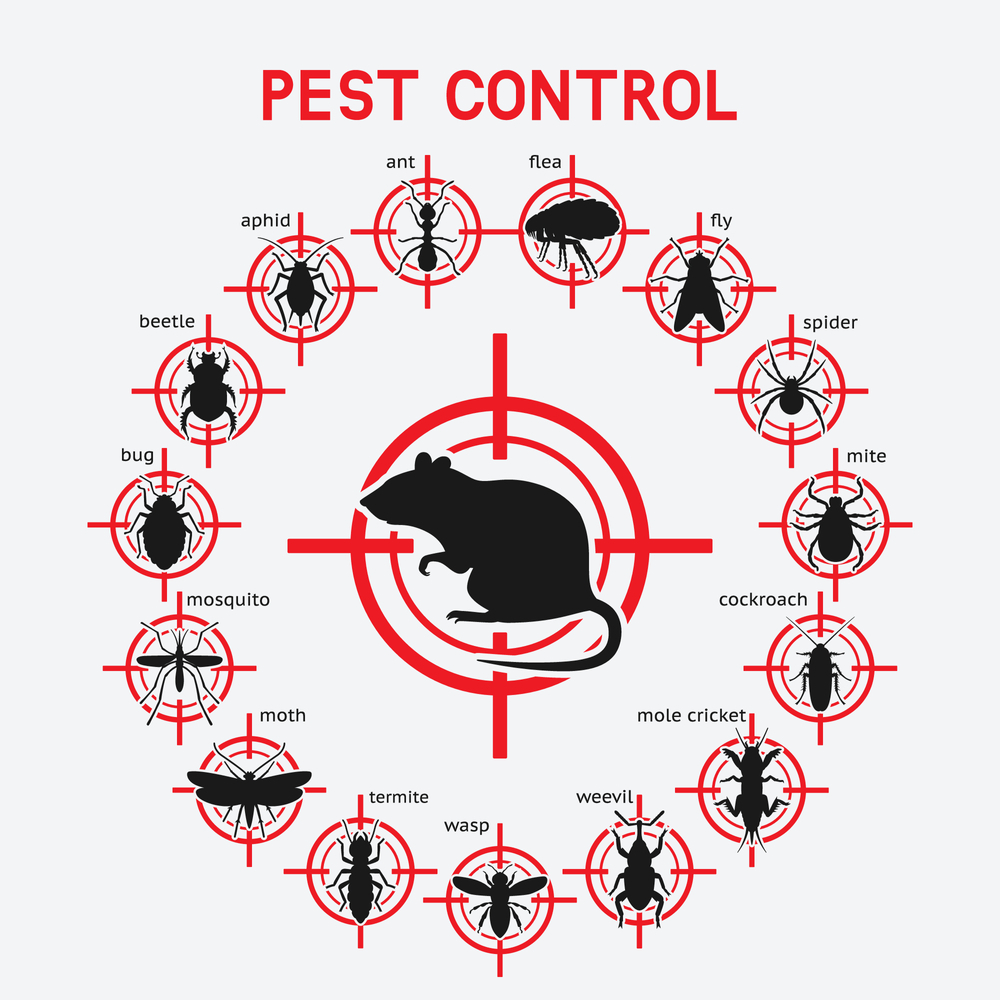

Expert tips to eliminate mice & rats in your home. Protect your property &

Discover the latest news, how-to’s and resources to help you keep your home and business pest free.

Stay Informed with Expert Pest Control Articles Delivered to Your Inbox Every Week.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

©2023 All right reserved | Pest Insight